Presenting the

MBA Fund

After 2 years of fundraising, we have a $26M Fund we are looking to deploy! If you are a Midwest Focused B2B/G high potential entrepreneur (HPE) with at least $1 million in annualized revenue looking for growth or acquisition capital support, we are here for you.

Propelling businesses to the next level of growth.

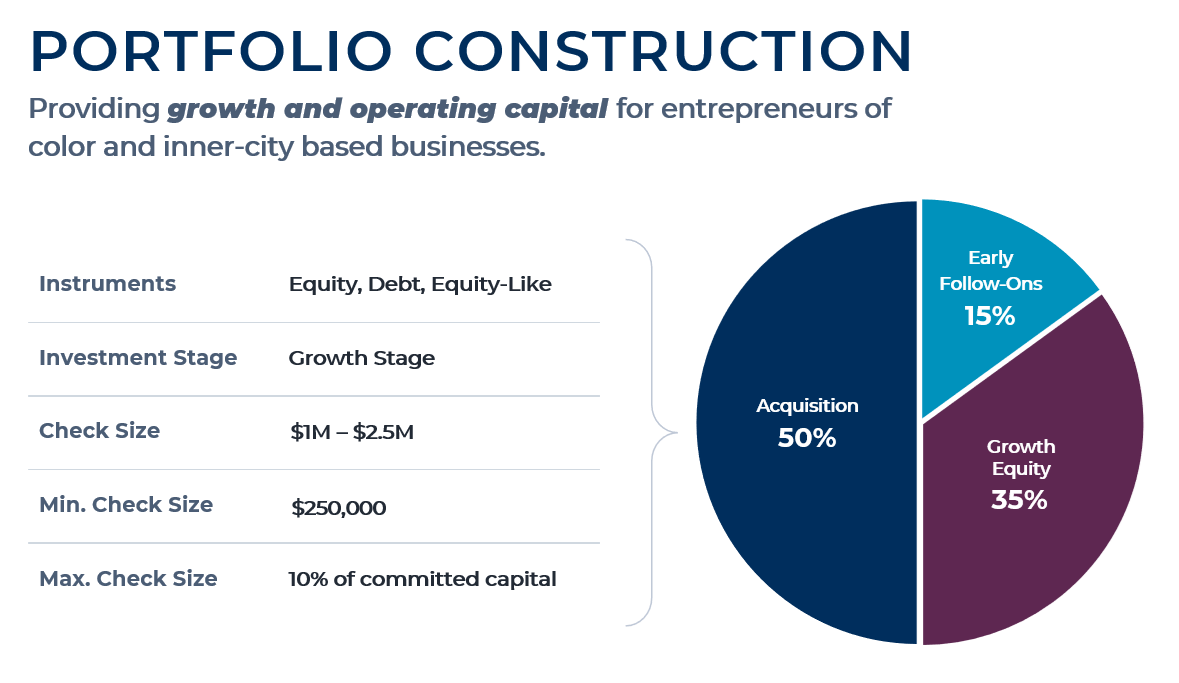

The Minority Business Accelerator Fund I (MBA Fund I) was created to address the well-documented gaps and shortfalls in the availability and access to equity and growth capital for high potential entrepreneurs seeking scalable business ventures and capital to support their growth goals.

The MBA Fund’s unique structure permits investments in both later and earlier stage minority-led businesses. For earlier stage companies that are post-seed stage capital, the MBA Fund will be the conduit to institutional venture capital firms, if not, then the Fund will provide capital required to secure such investments and make the connections required to achieve high growth.

Primary Investment FOCUS

The MBA Fund I is looking to solve an access level problem by helping high potential entrepreneurs (HPEs) scale their business ventures through growth strategy coaching and capital solutions.

The Minority Business Accelerator Fund I is a midwest focused fund providing equity, flexible debt, revenue based investments to support entrepreneurs purchase existing mainstream businesses with no identified business succession plan, as well as providing growth equity capital to help scale existing businesses.

Ready to Invest In You

As of December 2024, we have a $26.6M Fund deploying capital to founders in the Midwest region.

With the support of our amazing Investment Partners our investment fund is LIVE!

We are looking to deploy capital to Midwest Focused B2B/G minority owned businesses with at least $1mm in annualized revenue. If that is you, we are looking forward to connecting!

Apply today

Our Process

1. Apply

2. First Call

3. Due Diligence

4. Present to Committee